Case Study: Monopro and Re-Leased

How Monopro Family Office use real-time data to manage their commercial property portfolio.

Interview with Daniel Dangoor

Monopro is a family business that has been investing in property for 60 years, employing experience and nous to steer investments in the right direction. The business is now working to introduce processes that will ensure their continued success for generations to come, whilst protecting the core strengths that have led to their success.

Daniel Dangoor is the third generation to be involved in the business.

How can you build on a legacy of strong property asset management?

Ten years ago, Monopro was operating on very antiquated systems. Now, the business is run entirely on the cloud and makes decisions using real-time business intelligence dashboards, customised to their needs.

Whilst on this journey, it has been important for Monopro to retain the cores values that have made their family business successful.

“We are a family business, not a corporate, and even though we will always retain our core values, we need to introduce systems and processes as we grow.”

Moving from checkbooks to a modern, cloud-based business

Three years ago Monopro started looking at platforms to automate property management and provide access to data.

“I was frustrated by the need to constantly rehash data and try to squeeze in analytics in my spare time,” says Daniel.

Monopro was using Sage50 at the time and started their software search by considering Horizon, Yardi, and Arthur but quickly determined these products were not the right fit. A quick google search led Monopro to Re-Leased.

“Re-Leased ticked a lot of boxes. It is commercial focused and has a great synergy with Xero. Re-leased has been hugely influential for us, particularly not having to maintain all the different spreadsheets and offline processes. It moved the business forward leaps and bounds.”

However, Monopro knew they could be doing more with their data and analytics.

“As our business grows, there are more moving parts. When looking at our portfolio and making big decisions, for example diversifying into new asset classes, we knew we needed better access to data to make decisions. If we are going to borrow and be leveraged, we need to be confident we have the coverage.”

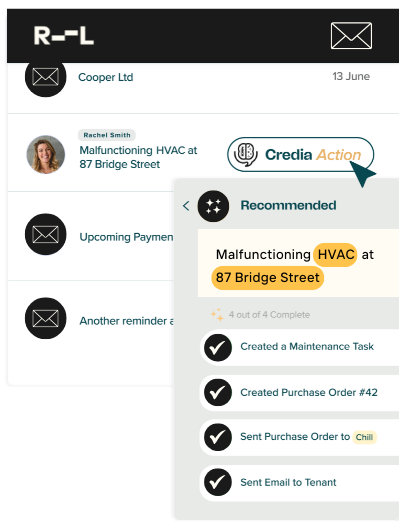

“Before Credia we haven't previously had the ability to compare properties over many years and really get an understanding of what works and what doesn't so that we can concentrate on what works.”

Setting up real-time business intelligence for a family real estate business

Monopro was introduced to Credia through the free to access Credia Index market data and reports. However, they were unsure whether the business intelligence platform would deliver the level of insights they required.

“Monopro pulled together a wish list of all the business insights that we had been dreaming of for the last ten years. We did not expect to be able to achieve everything on the list. However, after reviewing the list, Caleb’s response was “no problem”.

Credia has been better than we ever hoped for.”

After working closely with Caleb to build their Credia dashboards, Monopro now has access to business intelligence going back to the late 1990s for over 100 properties. This has given the team the means to start reflecting on Monopro’s portfolio, evaluating what has done well and what has failed, and using these insights to adjust the company's investment strategy.

Using business intelligence to make decisions

Monopro is interested in growing and diversifying their portfolio and in pursuing capital growth deals. However, in order to pursue these deals, the team needs to better understand how it fits into their investment strategy and provide detailed documentation. This is where Credia really comes into its own.

“We need to better understand this asset class so we can assess the relative benefits. For example, I can be London biased in terms of how I look for assets but using data helps to manage this bias.

“Credia gives us a sense of what sort of investments we should be looking out for and helps us to manage our cash flow. We now have the backing of good quality data and so can take the business up a notch and look for more ambitious gearing and assets.”

How it feels to operate with industry-leading business intelligence

Credia has been the final step on a long journey towards establishing industry-leading management processes and business intelligence at Monopro and the team has dedicated a lot of energy to drive this change.

It has been extremely exciting bringing on Credia. It is a dream that has been 8 to 10 years in the making.

Credia has been the final step on a long journey towards establishing industry-leading management processes and business intelligence at Monopro and the team has dedicated a lot of energy to drive this change.

“I have a huge sense of vindication seeing our dashboards come together. It was worth putting in the effort to get us here as we have emerged with industry-leading business intelligence. These things are critical in terms of growing your business.”

Working with the team at Re-Leased has been a big part of this journey.

I felt great excitement and satisfaction that there are other people out there that love data and numbers as much as I do.