Re-Leased | 11 July 2023

The office market is undergoing a significant transformation, marked by a seismic shift in tenant preferences and strategies. Recent data from Re-Leased reveals a notable decrease in the average length of office leases across the United Kingdom, New Zealand, and Australia, reflecting a shared trend in the commercial property industry. This article will focus on the office market, exploring the factors driving this shift and the implications for landlords and occupiers alike.

The Re-Leased Market Lens draws on one of the most extensive and live datasets in the commercial property industry. Delivering benchmarks and insight into the health of the commercial real estate market, this data focuses on occupier performance, leasing trends and national averages to uncover market conditions across asset classes.

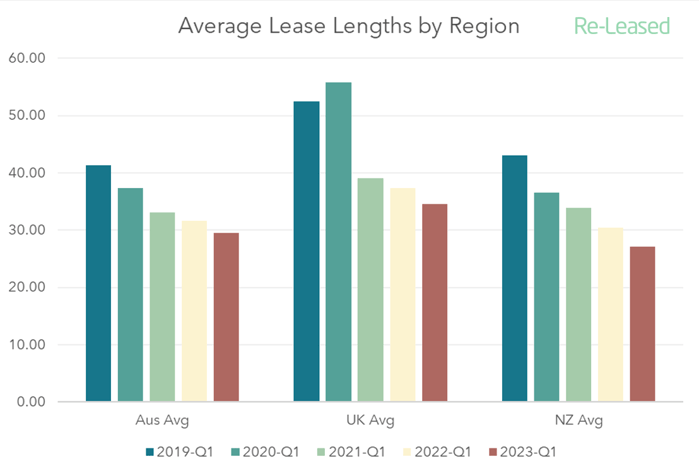

In the first quarter of 2019, the average office lease length in the UK stood at 52 months, equivalent to almost four and a half years. However, by Q1 2023, the average lease length had declined by 34%, settling at just 34 months, or two years and 10 months.

It's a trend also mirrored in the Australian and New Zealand markets. In the first quarter of 2019, the average office lease length in Australia stood at 41 months, or almost three and a half years. However, in Q1 2023, the average office lease length has dropped by 28%, settling at just 29.5 months, or just under two and a half years.

In New Zealand in Q1 2019, the average office lease length stood at 43 months, or three and a half years. However, in Q1 2023, the average lease length had a significant drop of 37%, settling at just 27 months, or two years and three months.

This decline indicates a fundamental change in tenant preferences and their approach to leasing office spaces.

Average Office Lease Lengths (Months)

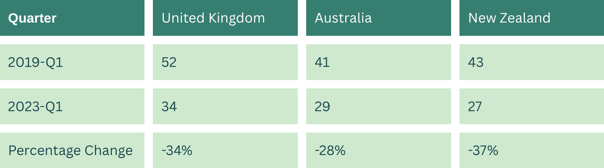

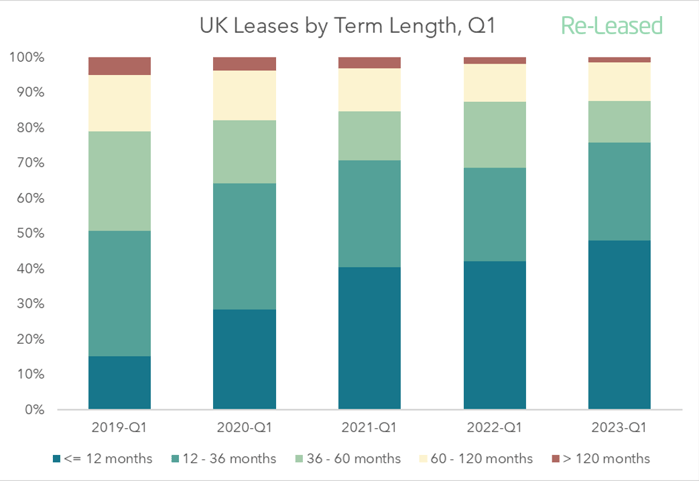

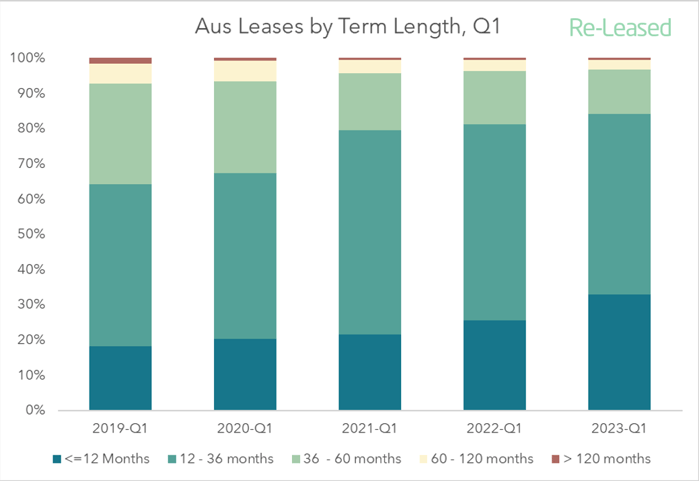

The data also highlights a surge in the demand for short-term leases, particularly those spanning up to 12 months.

In Q1 2019, leases of 12 months or less accounted for only 15% of all office leases in the UK. However, by Q1 2023, this figure had tripled to reach 48% of all leases.

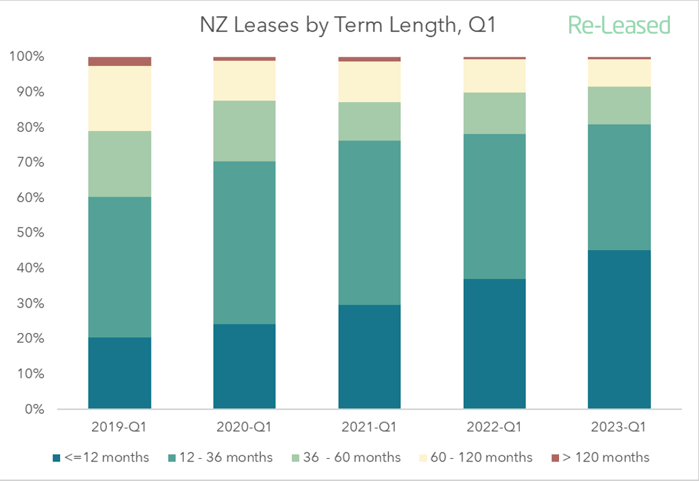

A similar trend is observed in New Zealand, where shorter leases increased from 20% to 45% within the same period. Australia experienced a significant jump as well, with leases under 12 months growing from 18% to 33%.

Multiple factors are driving this transformation in the office lease market. The rise of remote and hybrid working models has fundamentally reshaped the way businesses operate. This newfound flexibility has led to a decreased demand for long-term leases, as companies increasingly opt for shorter-term agreements that provide a greater ability to adapt to evolving needs.

Tom Wallace, CEO of Re-Leased, explains:

“There are a number of forces driving the increased demand for shorter, more flexible lease terms from businesses. While the pandemic is now in the rear-view mirror, companies are still determining what their office requirements will be in this new world of hybrid work. Given this uncertainty, there is a clear reluctance to commit to a long-term lease, especially with the rise in flexible office providers.

However, this creates a great opportunity for landlords to respond to changing demands by offering simpler short-term leases which streamline negotiations and minimise the need to offer incentives. This responsiveness not only gets them a better return on the space, but it also helps to keep renewal rates high.”

The declining lease lengths have significant implications for both landlords and occupiers in the office market. Landlords are facing increasing pressure to offer more flexible lease terms and services to attract tenants.

Sam Caulton, CFO of Re-Leased, highlights the shift in leasing relationships, stating:

"Landlords are now managing their leasing relationships with customer service at the forefront - to ensure leases are renewed. The focus on customer service and tenant satisfaction becomes paramount as the office market moves away from traditional long-term leases. Net Promoter Scores (NPS) are now being used to measure tenant satisfaction, underscoring the industry's rapid transformation.

------------------------------

The office lease market is experiencing a profound transformation as lease lengths shorten and the demand for flexibility increases. Remote and hybrid working models, coupled with economic uncertainties, have driven this shift, signalling a departure from traditional long-term leases. Landlords adapting to these changes are prioritising customer service and tenant satisfaction to navigate the evolving landscape successfully.

By embracing tenant flexibility and understanding the changing needs of businesses, stakeholders in the office market can position themselves for success. The ability to provide flexible lease terms, high-quality services, and a seamless leasing experience will be crucial in attracting and retaining tenants in this new era of office leasing. As the office market continues to evolve, landlords will reimagine their leasing strategies and explore innovative solutions to meet the demands of a dynamic workforce.

*This data has been collected, anonymised and aggregated from over 280,000 leases and 100,000 properties. All data that has been aggregated for this report is in line with the Re-Leased Terms and Conditions as at the time of publishing.